How to Trade the Diamond Pattern The Success Academy

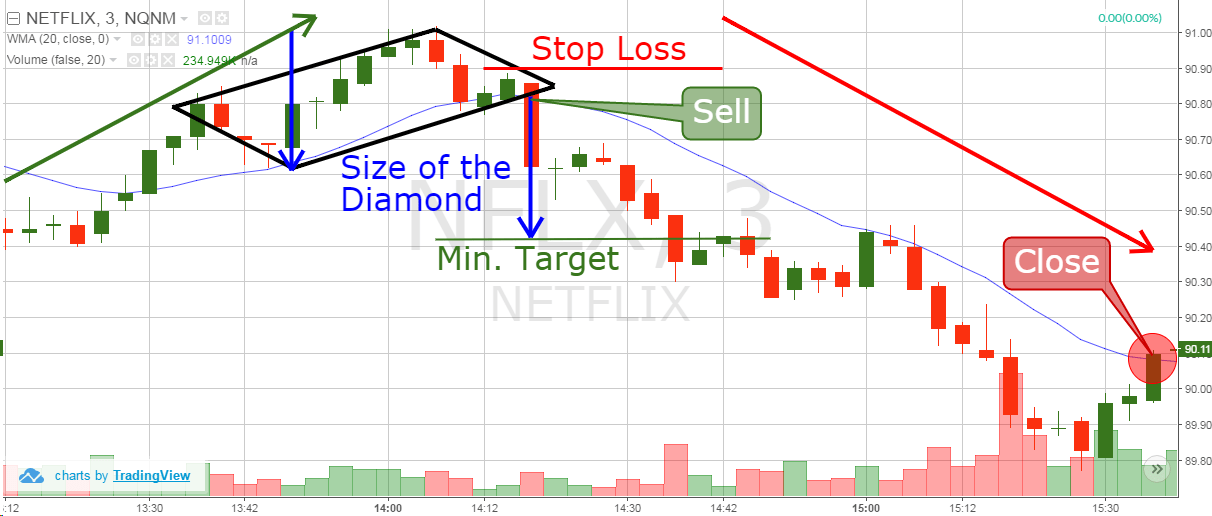

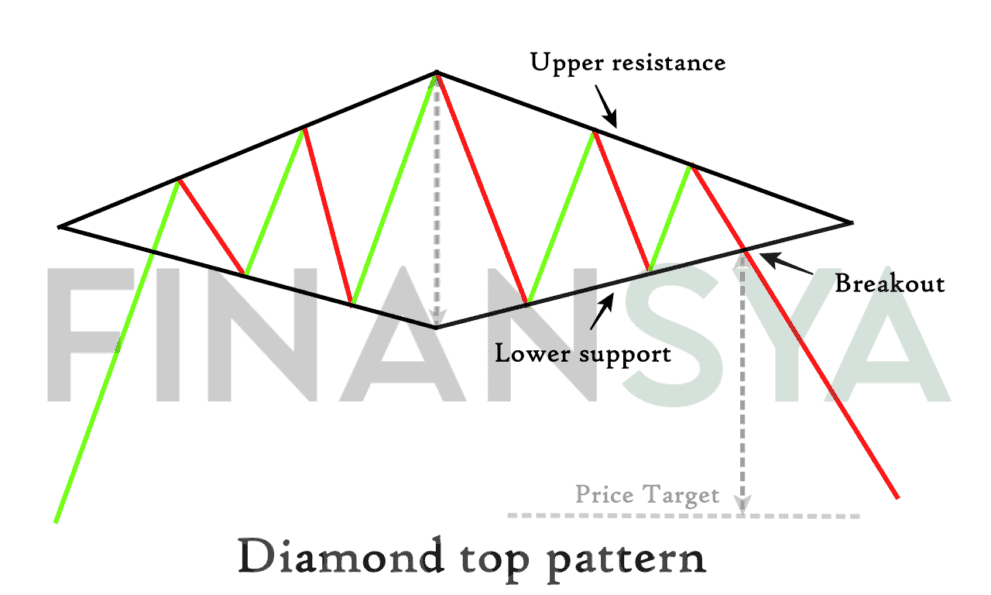

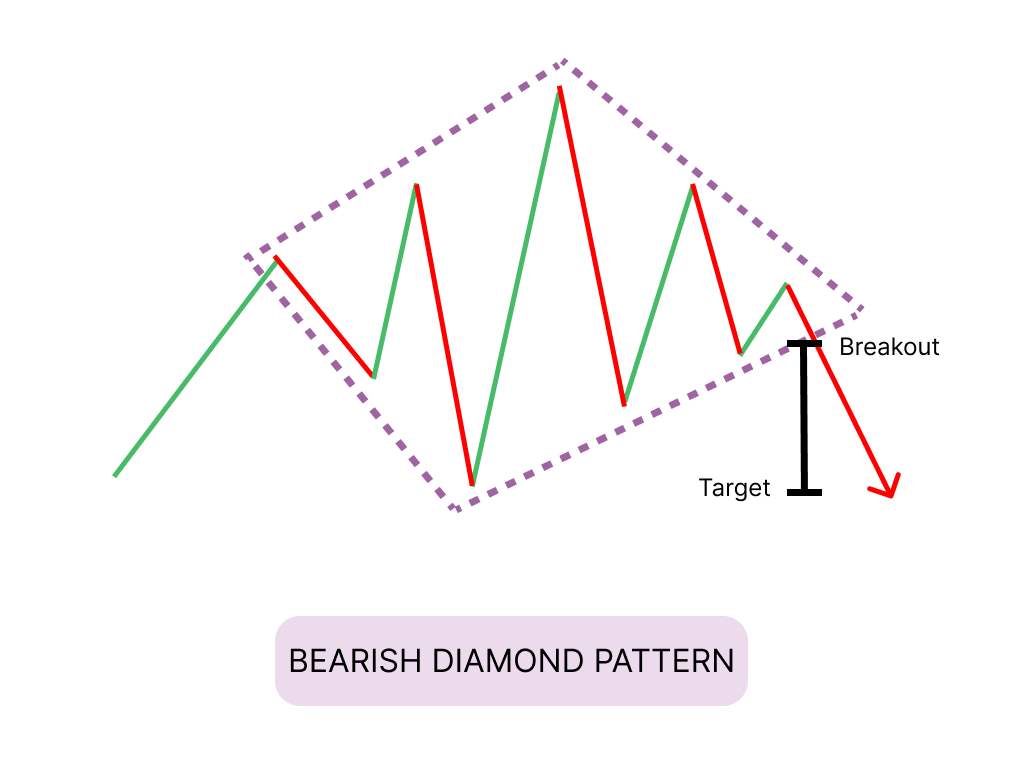

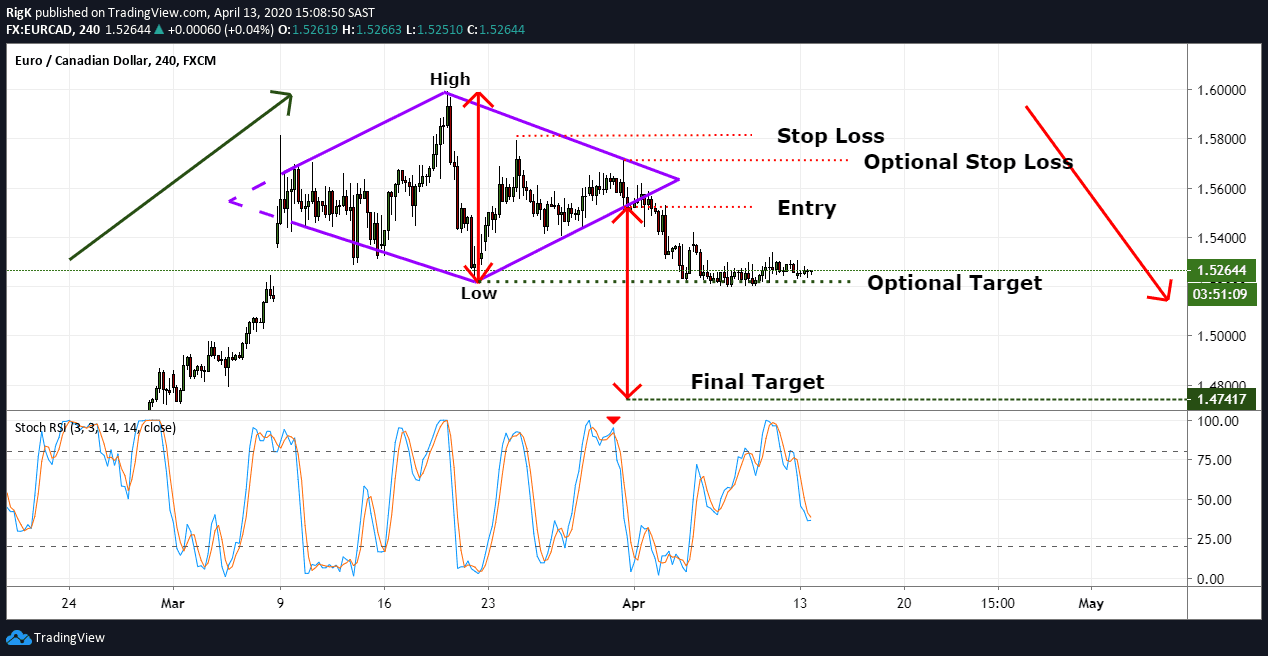

Diamond top pattern trade price targets are set by calculating the pattern's height between the swing low price and the swing high price range and subtracting this number from the short trade entry price. For example, if the swing high price is $30 and the swing low price is $20, then the height would be $10 and this $10 would be subtracted.

How to Trade Diamond Chart Patterns Winning Strategies TradingSim

A diamond chart pattern is a technical analysis pattern commonly used to detect trend reversals. It's a rather rare pattern. It occurs when the price starts to flatten after a steady uptrend or downtrend, which leaves a diamond-shaped formation on the chart. In this article, you will find answers to the following: What are diamond chart patterns?

Diamond Chart Pattern Trading Reversal Graphic Formations R Blog RoboForex

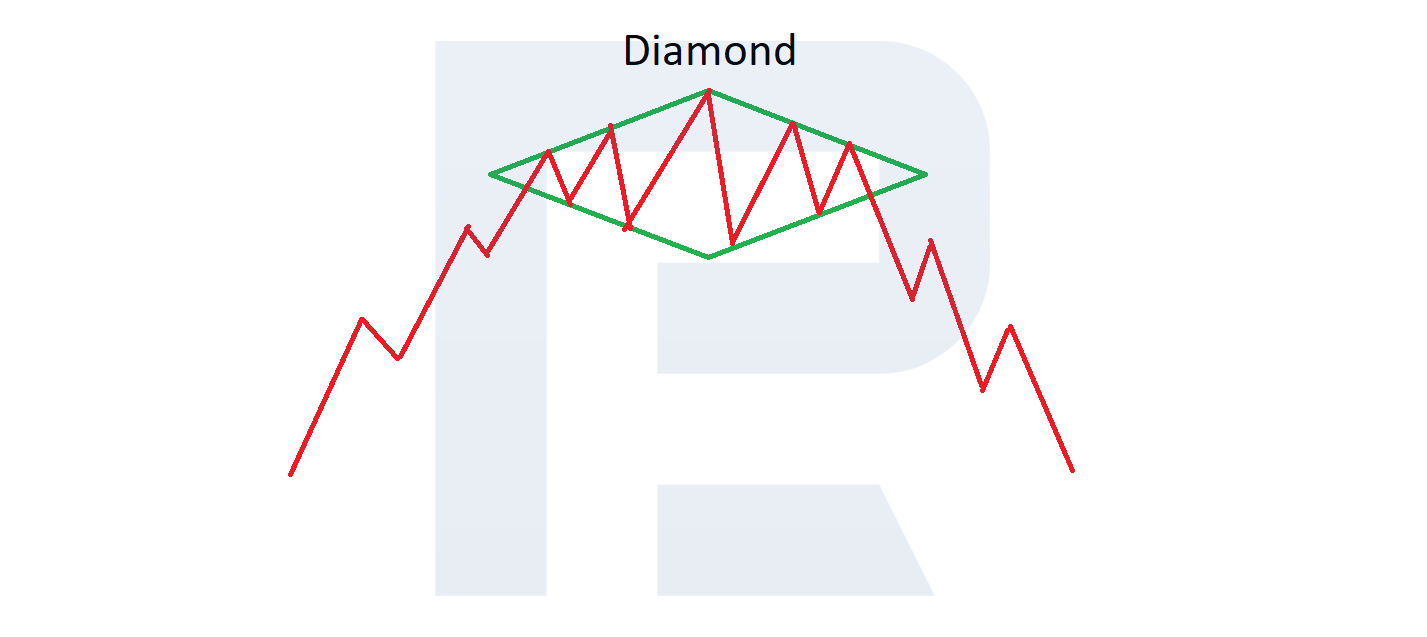

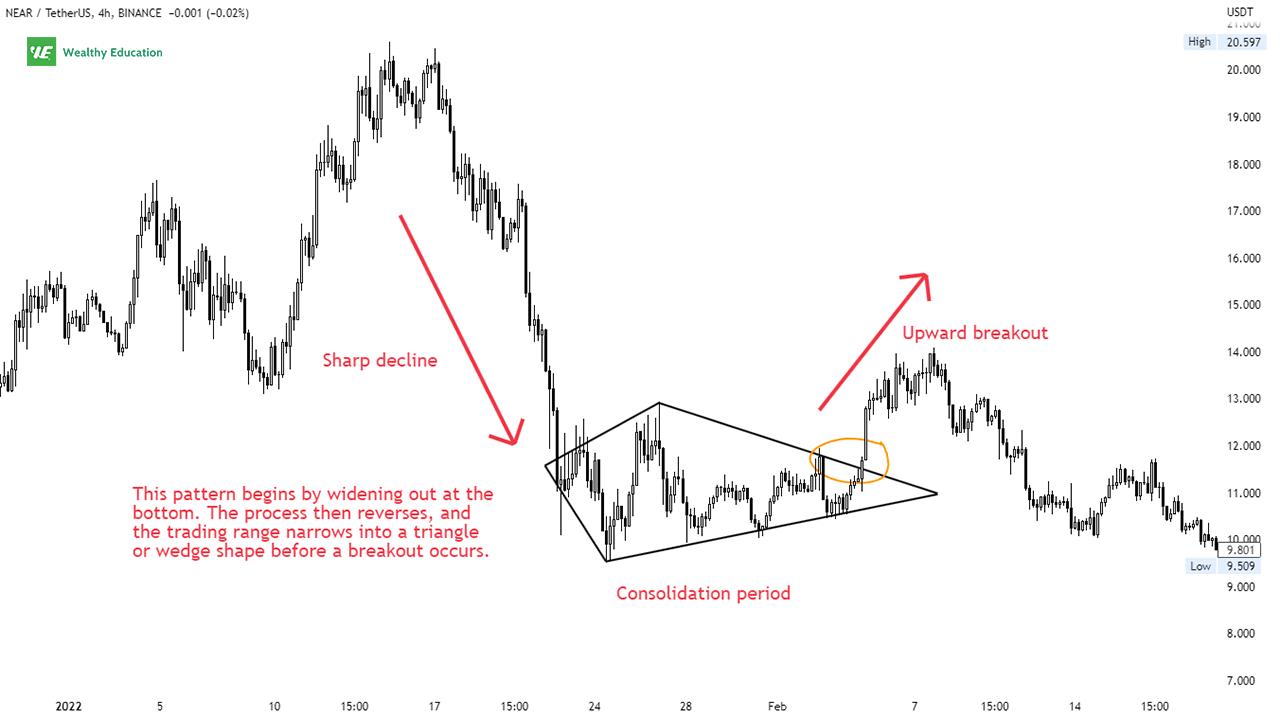

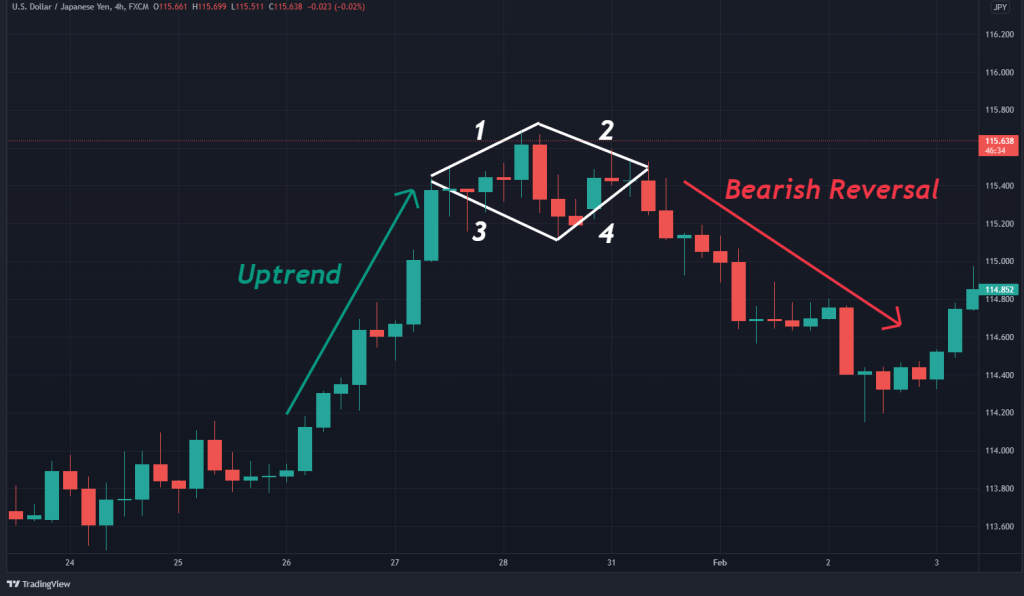

A diamond pattern is an advanced chart formation that occurs in financial markets and is used to detect reversals. It is one of the trading strategies for profitable reversal patterns. Its appearance most often occurs after a prolonged trend phase.

Diamond Pattern Guideline Download Free PDF

The diamond chart pattern is a technical analysis tool used by traders in different financial markets for breakout trading. The diamond pattern can provide valuable insights into potential price movements and trend reversals. However, it can be challenging to find it in a price chart. In this FXOpen article, we will tell you how to spot the.

Diamond Chart Pattern Explained Forex Training Group

Diamond Pattern Trading. The diamond pattern is an advanced chart pattern that is used for identifying reversals in the financial markets. When correctly utilized, it is one of the most profitable patterns for trading reversals. A diamond chart pattern has similarities to a head and shoulders pattern while having a V-shaped line.

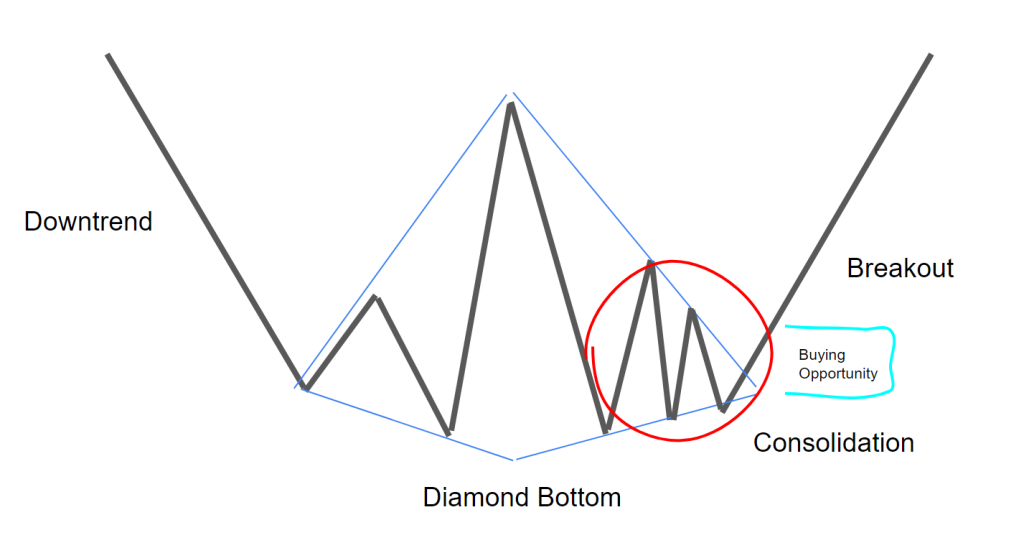

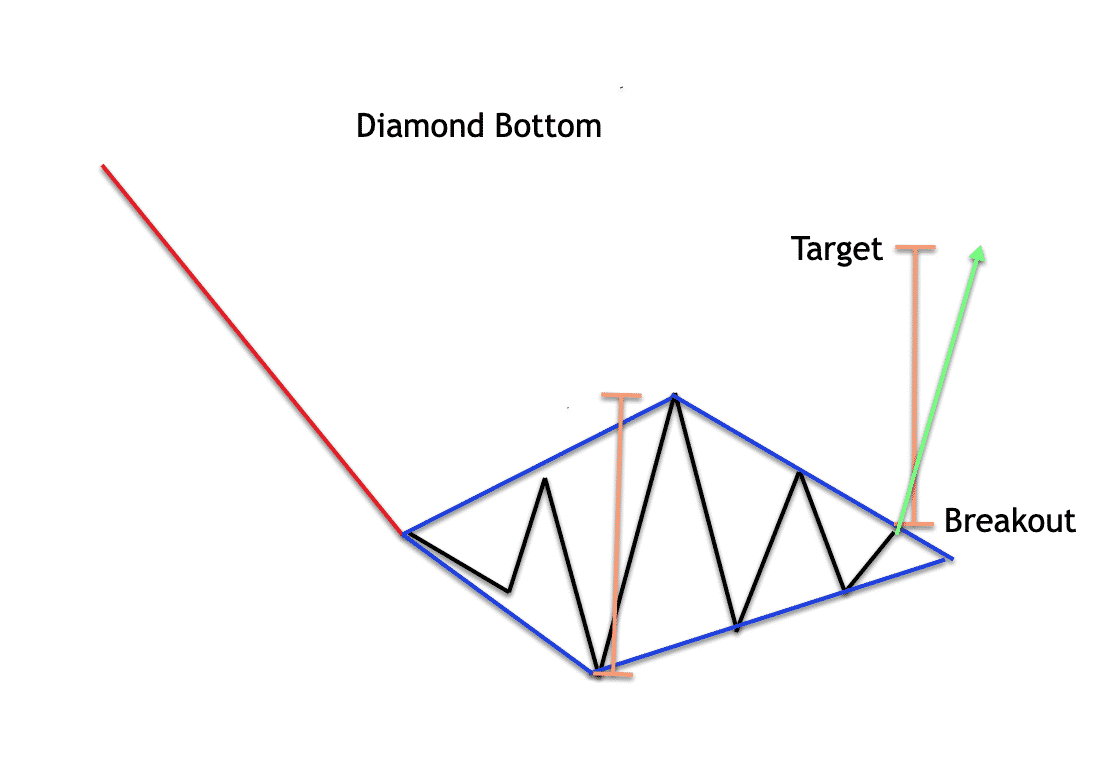

Diamond Bottom Pattern (Updated 2022)

A diamond top formation is a chart pattern that can occur at or near market tops and can signal a reversal of an uptrend. A diamond top formation is so named because the trendlines connecting.

Diamond Pattern Trading 4 Super Information To make Rich

Fig. 4. Diamond top pattern Stop Loss. The primary approach to setting the stop loss is below the diamond pattern swing low. You can easily set the Stop Loss by clicking the auto-close button from the Olymp Trade platform.. Take Profit. If the price moves higher from the entry-level, wait for 1:2 risk vs. reward to appear and close the trading position.

Pola Diamond Chart Pattern Pengertian, Ciri, Dan Cara Trading HSB Investasi

The diamond pattern is one of the best trading patterns suitable for trading and detecting reversals. Prediction is "the heartbeat" of a good trade: diamond pattern allows you to predict reversals easily. Reversal trading strategy is not new to experienced traders: it is the change in the asset price movement.

Diamond Pattern Trading The Ultimate Guide For Traders

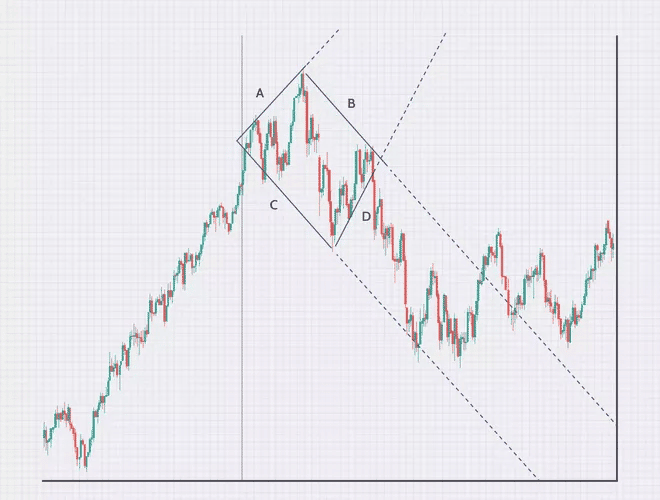

Diamond pattern trading is the strategy traders use to trade these rare trend reversal patterns. The diamond chart pattern is actually two patterns — diamond tops and diamond patterns. These patterns form on a chart at or near the peaks or valleys of a move, their sharp reversals forming the shape of a diamond.

Diamond Pattern Trading Explained

A less talked about but equally useful pattern that occurs in the currency markets is the bearish diamond top formation, commonly known as the diamond top. In this article, we'll explain how.

Diamond Pattern Trading How to Identify and Use The FX Post

Diamond Chart Pattern Definition A diamond chart formation is a rare chart pattern that looks similar to a head and shoulders pattern with a V-shaped neckline. Diamond chart reversals rarely happen at market bottoms, it most often occurs at major tops and with high-volume.

Diamond Top Pattern Definition & Examples (2023 Update)

The diamond pattern is a reversal indicator that signals the end of a bullish or bearish trend. It is most commonly found at the top of uptrends but may also form near the bottom of bearish trends. This leads to two distinct diamond patterns: the bullish diamond pattern and the bearish diamond pattern.

Diamond Chart Pattern How to Trade perfect guide by Margex

Diamond-like patterns are formed by two converging trend lines between which prices oscillate. Below is a trading strategy for trading diamond patterns: Identify the pattern: the first step in diamond pattern trading is to identify the pattern on the price chart. Look for a pattern that has two converging trend lines between which prices oscillate.

How to Trade Diamond Pattern Diamond Pattern Trading

Diamond Pattern Trading: Learn the Basics By Leanna Kelly Updated Jun 18, 2021 at 12:53PM Diamond pattern trading isn't for beginners! Not only are these patterns rare, but also they're often wildcards, breaking up or down regardless of bullish or bearish indicators.

Diamond Pattern Trading How to Identify and Use The FX Post

What Is a Diamond Chart Pattern? 2. How To Identify Diamond Chart Pattern 3. Types of Diamond Chart Patterns 4. Spotting Diamond Patterns in Real Charts 5. Trading Strategies with Diamond Chart Patterns 6. Performance Matrix for Diamond Pattern 7. Risk Management and Stop Loss 8. Common Mistakes to Avoid 9.

How to Trade the Diamond Chart Pattern (In 3 Easy Steps)

Diamond pattern trading is where a trader will use a specific chart setup, that is shaped like a diamond (shock!), to indicate a potential reversal opportunity in the near future. These setups are quite rare, but they are powerful. They are named after the diamond shape formed when the lines connecting the price highs and lows form a diamond shape.